SSC CGL Income Tax Inspector Salary

The SSC CGL Income tax inspector job is a dream job for every aspiring candidate. When appearing for the SSC CGL examination, this job is among the first ones to come to mind. Many of you must be curious to know about the exact Income Tax Inspector Salary, job responsibilities, work timings, and career growth of the SSC CGL Income tax inspector in the Central Board of Direct Taxes. Income tax officers in CBDT are recruited through the SSC CGL examination conducted every year by the Staff Selection Commission.

This article clears your thoughts about the working hours of the Income Tax Inspector, promotions, job profile, in-hand salary and detailed salary structure to create a transparent view on the post.

SSC CGL Income Tax Inspector (CBDT) Salary

The in-hand salary of an income tax inspector may vary as per your city. Apart from the basic salary, the Income Tax Inspectors enjoy various perks and allowances provided by the government in lieu of their services rendered. Check out the in-hand salary in the table below.

| Pay Level of Posts | Income Tax Inspector Salary (Pay Level-7) | |

|---|---|---|

| Payscale | Rs 44900 to 142400 | |

| Grade Pay | 4600 | |

| Basic pay | Rs 44900 | |

| HRA (depending on the city) | X Cities (27%) | 12123 |

| Y Cities (18%) | 8082 | |

| Z Cities (9%) | 4041 | |

| DA (Current- 50%) | 22450 | |

| Travel Allowance | Cities- 3600, Other Places- 1800 | |

| Gross Salary Range (Approx) | X Cities | 79,473 |

| Y Cities | 75,432 | |

| Z Cities | 71,391 | |

SSC CGL Income Tax Officer Job Responsibilities

- An Income tax officer can have two types of work profiles that are transferable on a cyclic basis.

- Work related to the assessment of tax or non-assessment of tax.

- It is often believed that Assessment postings are “cream postings” as they associate themselves with discretionary powers. The core job of assessment postings is to see the work related to the assessment of income tax to be imposed on an individual, partnership firm, company, etc; and refund it in case someone has deposited in excess.

- He also has to see the work related to TAX DEDUCTION AT SOURCE (TDS) besides being accompanying a raid team. But if you are in the Investigation wing, you may have to work even on the weekend if you are on search duty (Raid).

- You have to work for 3-4 days, without a break. No one would allow you to take holidays during peak season.

- An ITI on a non-assessment seat generally has to do clerical work. Such postings are in Headquarters, judicial postings, HR works, TDS, Training, etc. You may finish your work in less than 3 hours, and the rest of the day is yours. You may be asked to accompany a raid team.

SSC CGL Salary 2024, Check Post-Wise Salary Structure

Work Timing for Income Tax Inspector

Office timings are 9:00 AM to 5:30 PM. It varies slightly from zone to zone. There is no extra work but in some exceptional cases like when on raid or search, you may have to work without thinking of the time. The name Income Tax Inspector comes with the implied word regarding inspection. Candidates selected for this post are provided with proper training before actual deployment in the field. Being in the field is one of the most exciting aspects of this job and also one of the most rewarding. While working in the field, Income Tax Inspectors gain a wide range of life experiences and lessons that prove beneficial in the long run.

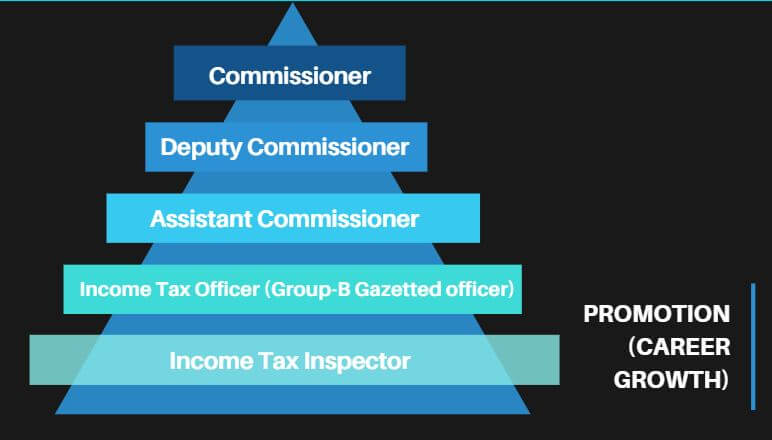

Promotion (Career Growth)

Along with the SSC CGL Income tax Inspector Salary see the infographic below the Growth path in terms of post hierarchy. Candidates selected for this post at a young age have the highest chances of getting to the top offices. However, initially, they have to work under the guidance of Indian Revenue Service (IRS) officers to gain the proper tools to implement their authority practically and ethically.

- You have to clear the Departmental Exam to become an ITO (Income Tax Officer).

- The Time taken to become an ITO differs from state to state.

- In states like Kerala, ITIs have become ITOs within 4 years. Generally, it takes 6-8 years to become an ITO from ITI.

- One can get the first promotion in this job after completing eight years of service after clearing the departmental exam.

- The promotion period differs from zone to zone since there is zonal seniority.

SSC CGL Income Tax Inspector Cut-off

The SSC CGL Tier I cut-off for the post of Income-tax inspector in 2023 and 2022 has been depicted below. Candidates preparing for this post in the year 2024 can take reference of this table to analyze the trend and map out their strategies for clearing the cutoff and securing their dream job.

| SSC CGL Income Tax Inspector Cut-Off | ||

|---|---|---|

| Category | Income Tax Inspector Cut-Off 2023 (Tier I) | Income Tax Inspector Cut-Off 2022 (Tier I) |

| UR | 150.049 | 114.27 |

| OBC | 145.937 | 102.35 |

| SC | 126.682 | 89.08 |

| ST | 118.166 | 77.57 |

| EWS | 143.444 | 114.27 |

| OH | 115.984 | 70.69 |

| HH | 77.727 | 40 |

| Others-PWD | 57.453 | 40 |

Delhi Police Constable and Head Constabl...

Delhi Police Constable and Head Constabl...

SSC CGL Salary Per Month, Check In hand ...

SSC CGL Salary Per Month, Check In hand ...

SSC GD Salary 2026, Constable Salary Str...

SSC GD Salary 2026, Constable Salary Str...